Please enter a valid email address

Please enter a password

Your password must have at least {ruleValue} characters

Your password cannot be longer than {ruleValue} characters

Both email addresses do not match

Both passwords do not match

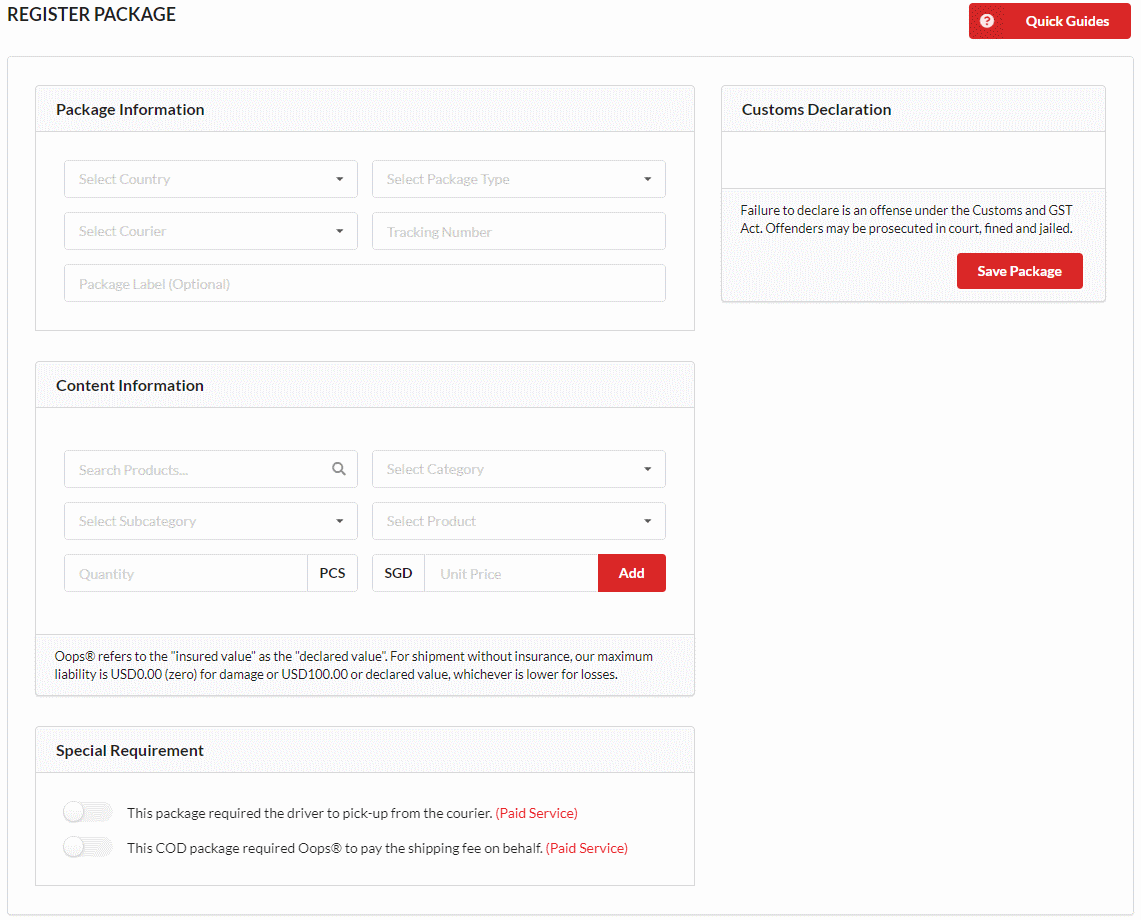

- Register Package

- In most cases, after you checkout using the warehouse address with a unique mailbox number assigned by our system, your seller will provide at least a tracking number to track goods.

- It is advisable to register all the package's tracking number in our system before the package arrives at our warehouse as this can help us eliminate possible human error.

-

To register the tracking number, please click the "Register Package" button at bottom of "DIY Reship Service - Incoming" page and you will be redirected to the "Register Package" page.

-

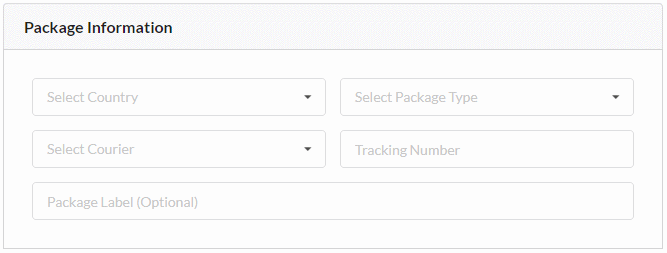

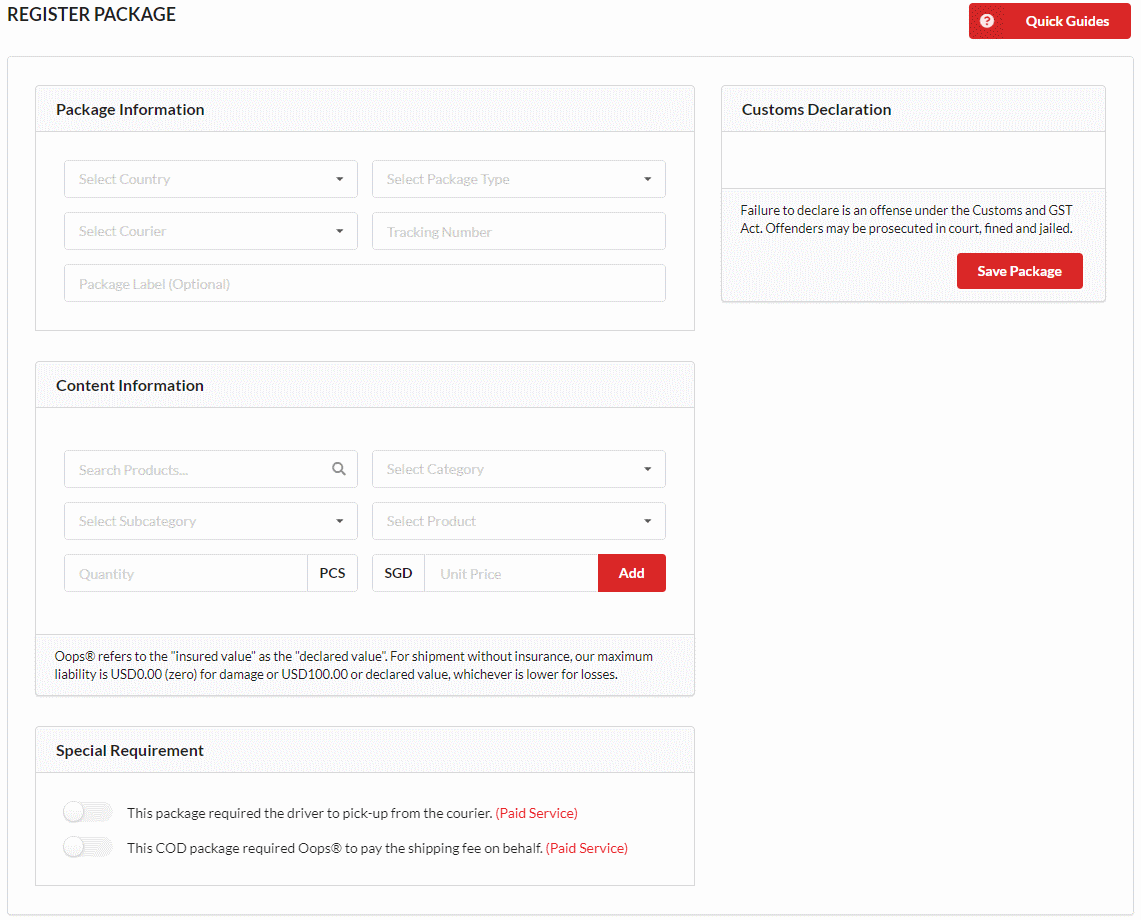

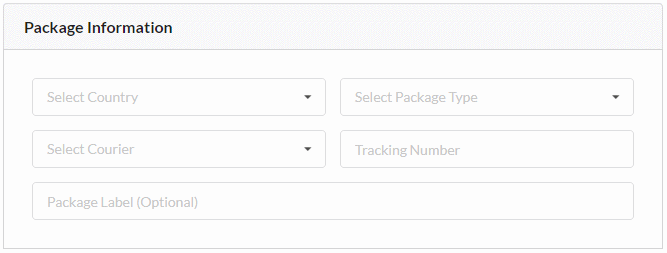

Under the "Package Information" section of the "Register Package" page, please select the "Country", the "Package Type" and the "Courier" and fill in the "Tracking Number" you received from your seller.

-

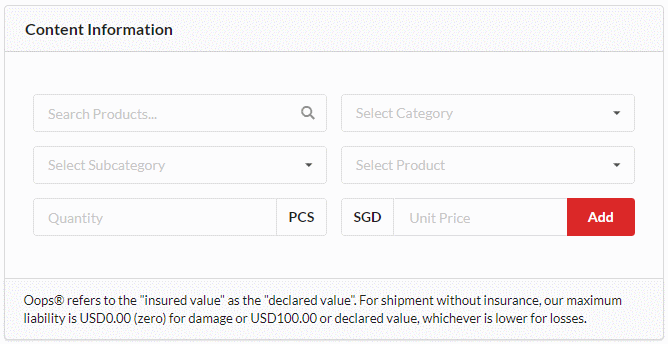

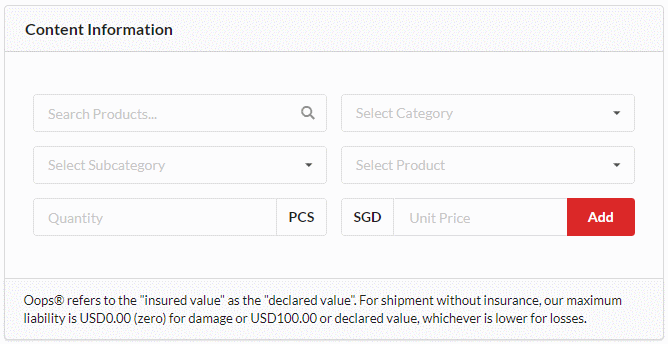

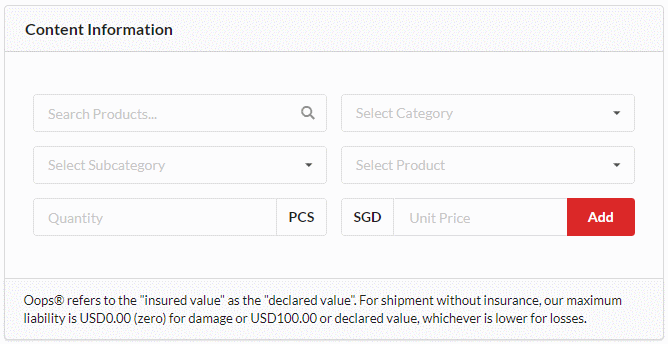

Under the "Content Information" section of the "Register Package" page, search from our database for the nearest product which matches your order. Input the "Quantity" and the "Declared Value" (Unit Price) and click the "Add" button to add the product to the "Customs Declaration" section on the right.

- Click the "Save Package" button at the "Customs Declaration" section when you are done.

- Action Required Package

-

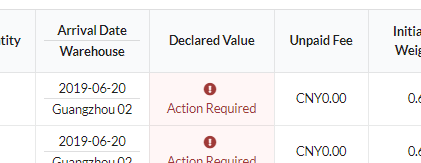

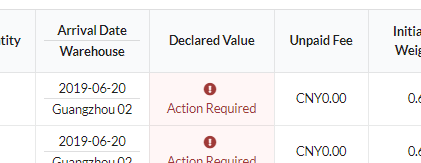

It is advisable to register all the package's tracking number in our system before the package arrives at our warehouse. If your package's tracking number is not registered before your package arrives at our warehouse, the "Action Required" message will appear under the "Declared Value" of your package.

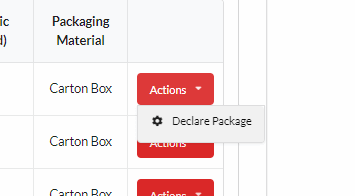

-

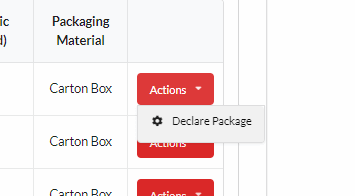

The main reason why an unregistered package appeared as an action required package is because there is no declare value and content. What you need to do is click the "Actions" button at the most right, select "Modify Package" and you will be redirected to the "Modify Package" page.

-

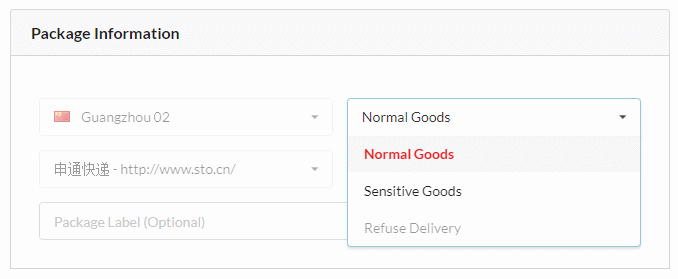

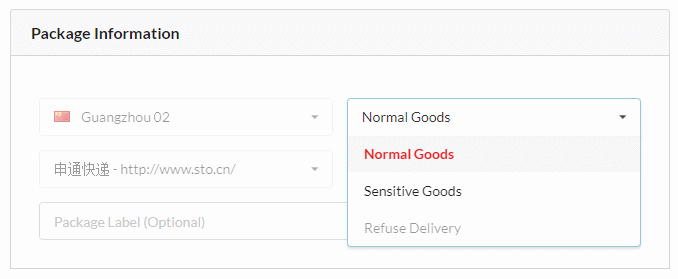

Under the "Package Information" section of the "Modify Package" page, please select either "Normal Goods" or "Sensitive Goods" for the "Package Type".

-

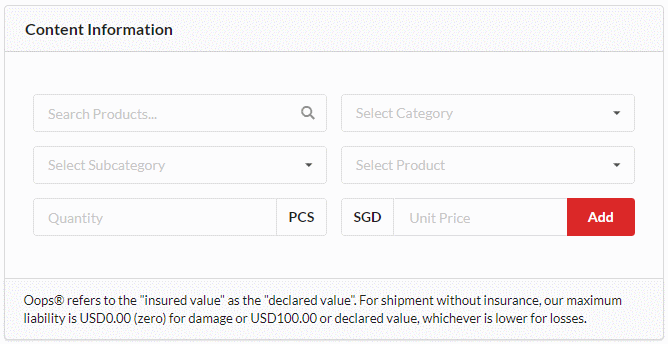

Under the "Content Information" section of the "Modify Package" page, search from our database for the nearest product which matches your order. Input the "Quantity" and the "Declared Value" (Unit Price) and click the "Add" button to add the product to the "Customs Declaration" section on the right.

- Click the "Save Package" button at the "Customs Declaration" section when you are done.

- Start Shipping

-

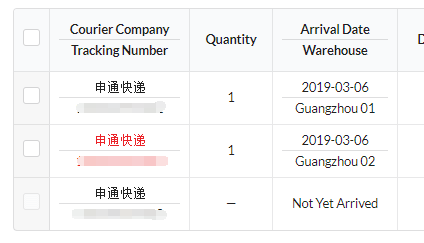

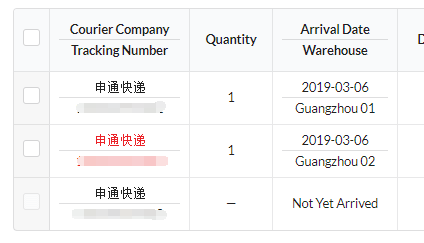

For all the goods arrived in our warehouse, our system will show not only "Quantity" but also "Arrival Date" and "Warehouse" where goods are received, otherwise the "Not Yet Arrived" message will appear.

- You can select the goods you want to consolidate and ship out by clicking the checkbox on the left and click "Start Shipping" button. Please note that you only can select tracking numbers from the same warehouse.

-

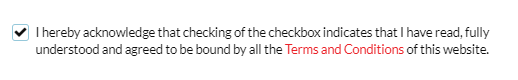

Please make sure you read and understood our "Terms and Conditions" before you proceed with prepare shipment.

-

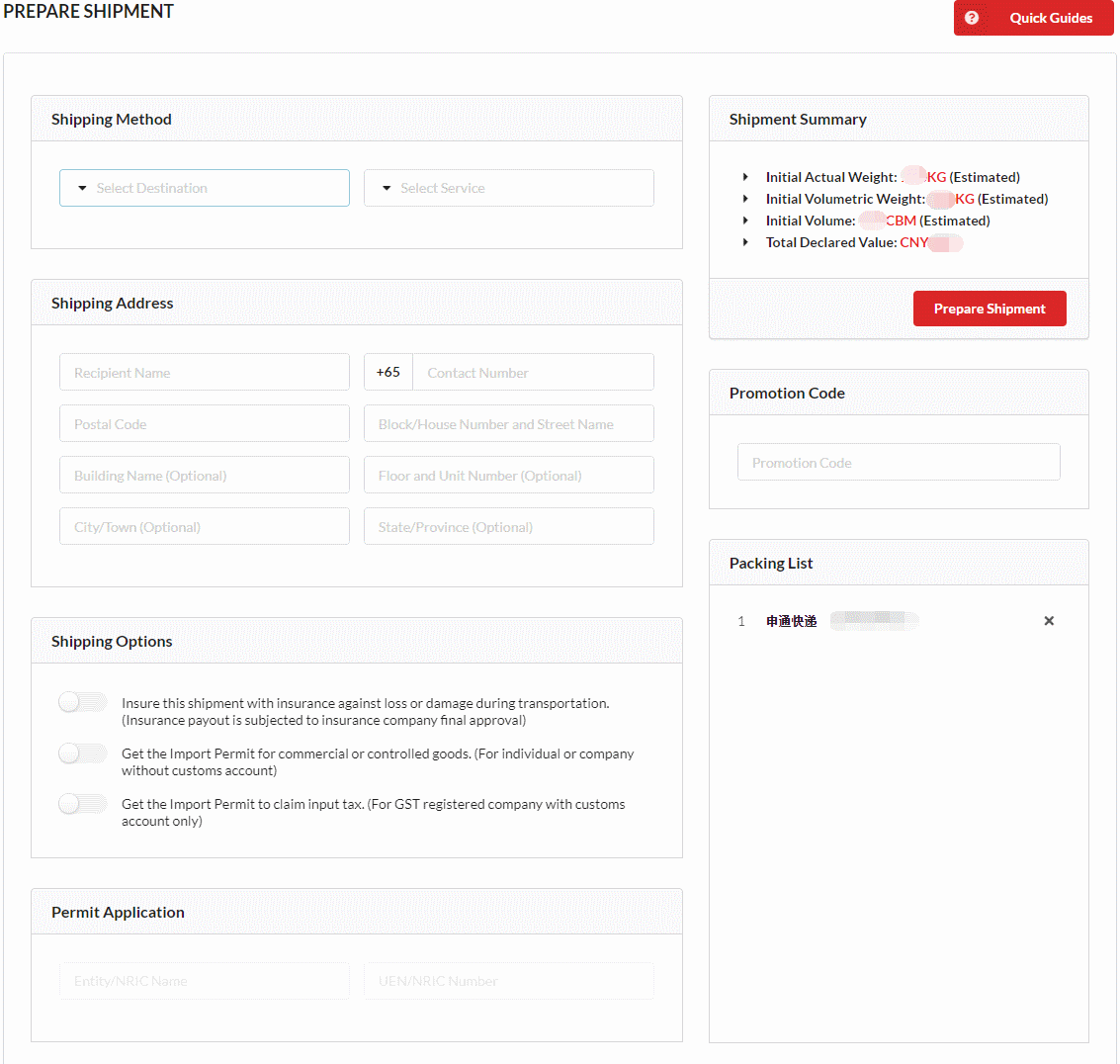

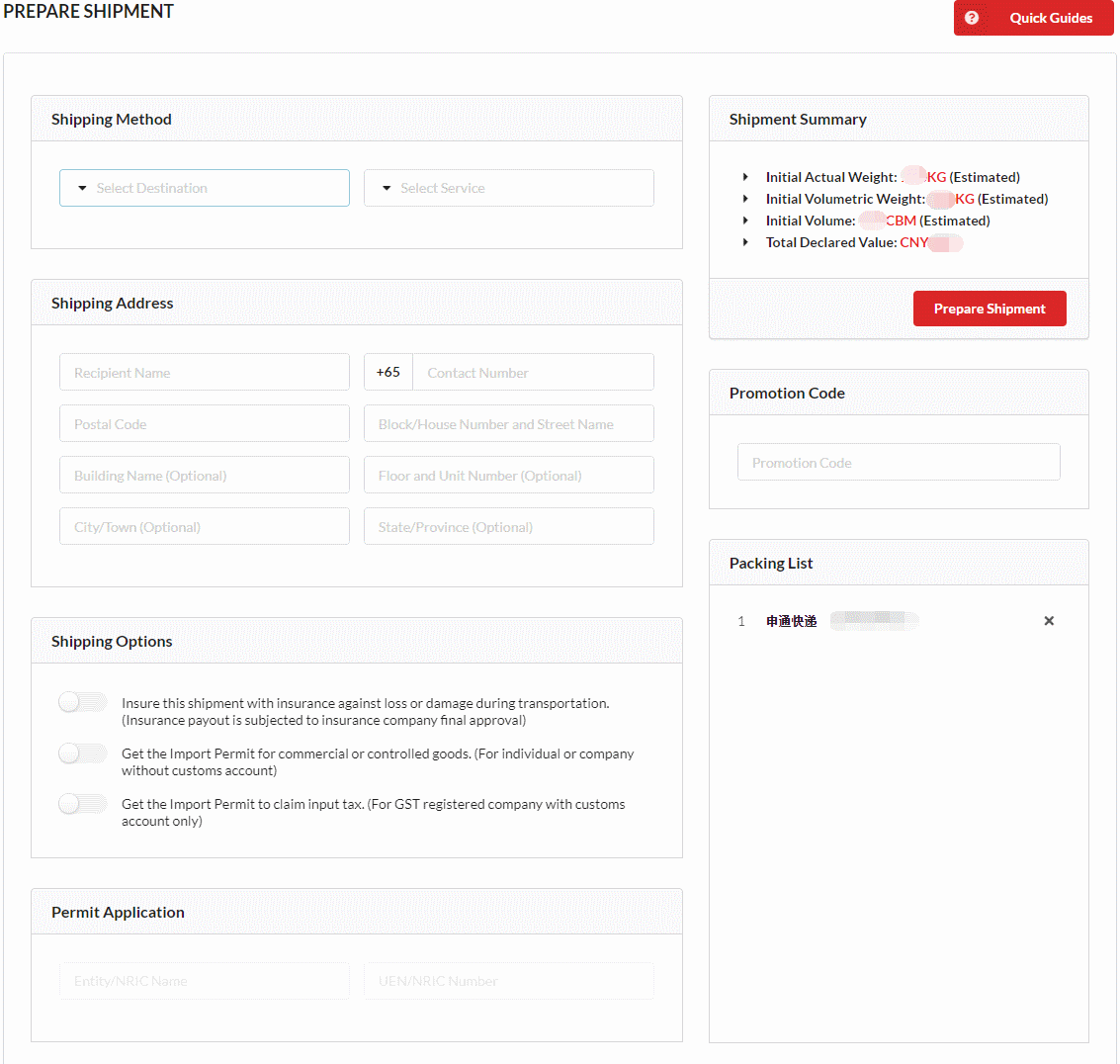

After clicking the "Start Shipping" button at bottom of "DIY Reship Service - Incoming" page, under "Shipping Options" select "Create a new shipment", click "Prepare Shipment" button and you will be redirected to the "Prepare Shipment" page.

-

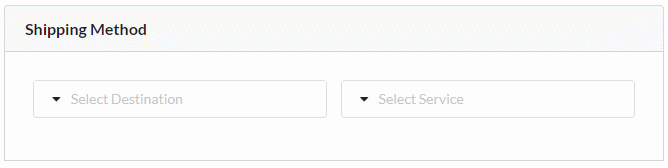

Under the "Shipping Method" section of the "Prepare Shipment" page, please select the "Destination" and the "Service" you want to use.

-

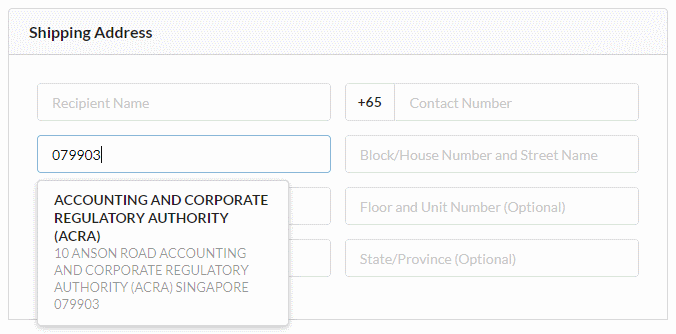

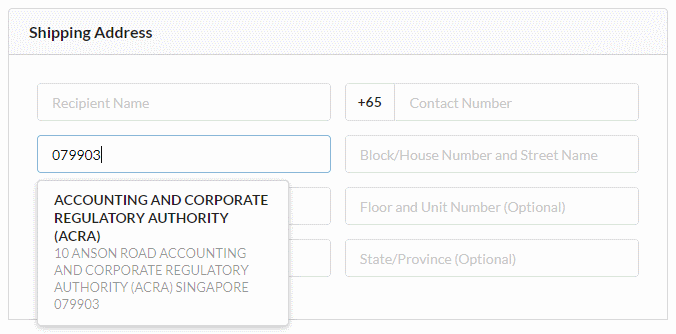

Under the "Shipping Address" section of the "Prepare Shipment" page, please fill in the recipient information. Singapore's customers can input the postal code to auto-fill the address.

- Click the "Prepare Shipment" button at the "Shipping Summary" section when you are done.

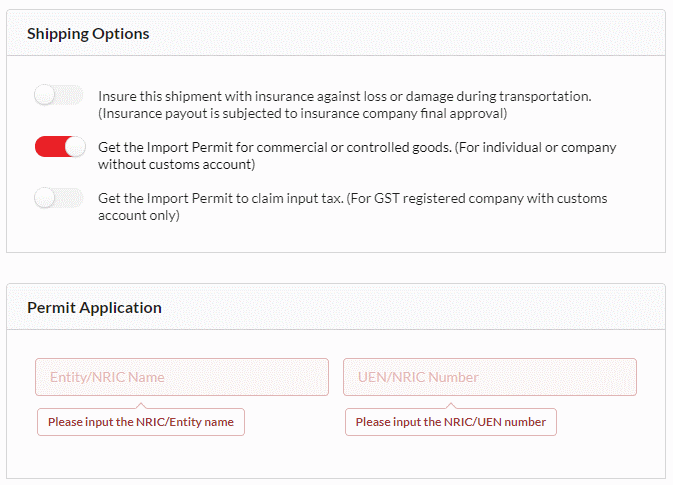

- Permit (Singapore User Only)

- Goods imported to Singapore are subject to payment of Goods and Services Tax (GST) and/or duty.

- GST relief is granted on goods imported by post or air, excluding controlled goods of Competent Authority (CA), with a total Cost, Insurance and Freight (CIF) value not exceeding SGD400.

- GST relief is not granted for goods imported by other transport modes e.g. sea freight and land unless specified by Immigration and Checkpoints Authority (ICA).

-

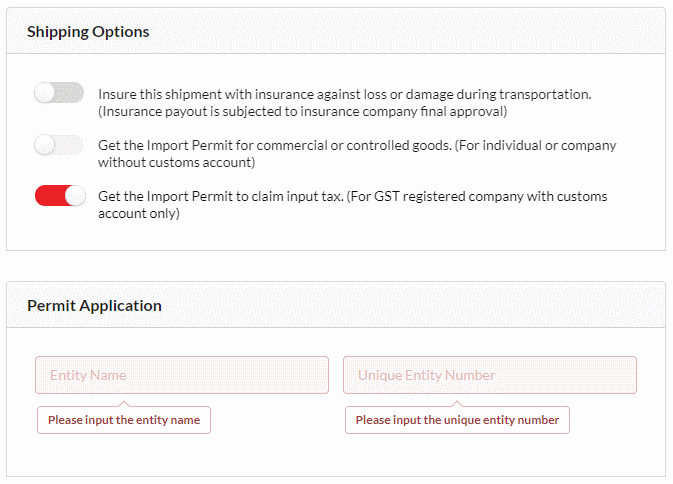

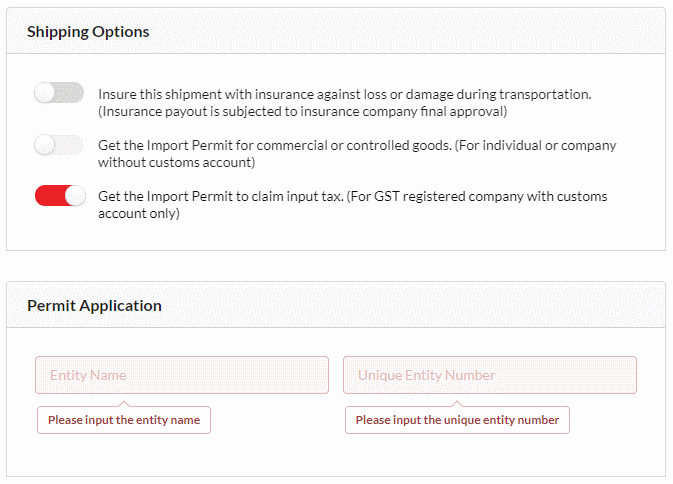

If you are a GST registered company who wants to claim back the input tax or your company needs to import controlled goods, please select the option below and fill in your company's entity name and unique entity number under the "Permit Application" section.

-

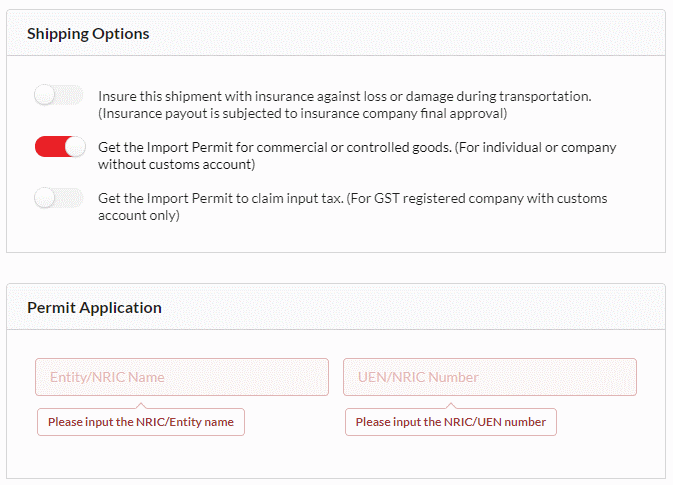

If you are not a GST registered company or individual who needs to import controlled goods or needs "Cargo Clearance Permit" for your shipment, please select the option below and fill in your company's entity name and unique entity number or your name and NRIC number under the "Permit Application" section.